Renters Insurance in and around Columbus

Welcome, home & apartment renters of Columbus!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Columbus

- Phenix City

- Georgia

- Alabama

- Harris County

- Lee County

- Russell County

- Ladonia

- Smith Station

- Buena Vista

- Hamilton

- Crawford

- Auburn

- Opelika

- Fort Mitchell

- Salem

- Pine Mountain

- Fortson

- Cusseta

- Marion County

- Chattahoochee County

- Richland

- Ellaville

- Reynolds

Protecting What You Own In Your Rental Home

Being a renter doesn't mean you are 100% carefree. You want to make sure what you own is protected in the event of some unexpected mishap or accident. And you also need liability protection for friends or visitors who might stumble and fall on your property. State Farm Agent Jeff Krietemeyer is ready to help you handle the unexpected with high-quality coverage for your renters insurance needs. Such considerate service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Jeff Krietemeyer can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Welcome, home & apartment renters of Columbus!

Renting a home? Insure what you own.

Why Renters In Columbus Choose State Farm

When the unanticipated tornado happens to your rented townhome or apartment, often it affects your personal belongings, such as a tool set, a set of favorite books or a microwave. That's where your renters insurance comes in. State Farm agent Jeff Krietemeyer has the knowledge needed to help you examine your needs so that you can insure your precious valuables.

Renters of Columbus, State Farm is here for all your insurance needs. Call or email agent Jeff Krietemeyer's office to get started on choosing the right savings options for your rented space.

Have More Questions About Renters Insurance?

Call Jeff at (706) 563-6993 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

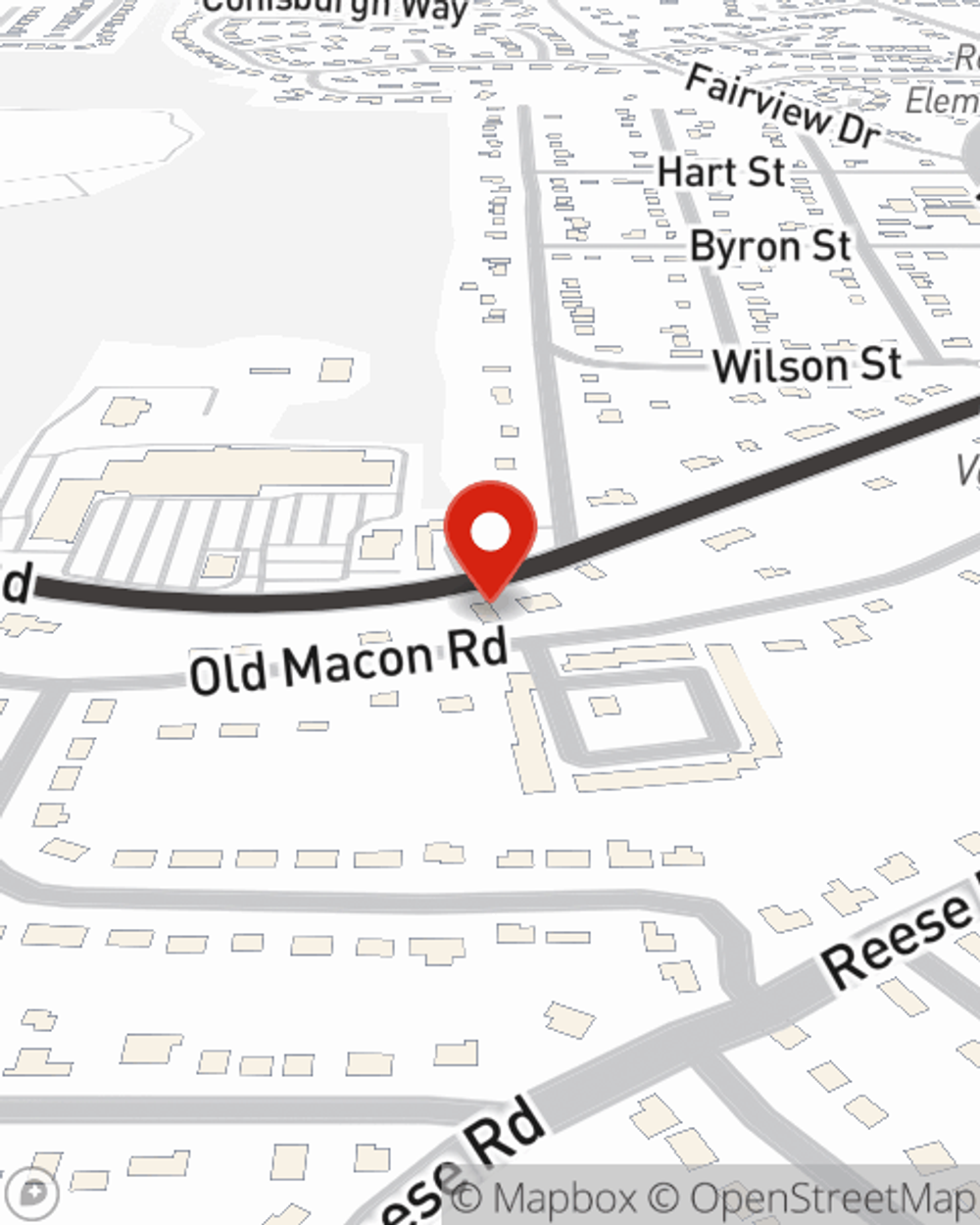

Jeff Krietemeyer

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.